What is a Chart of Accounts? A How-To with Examples Bench Accounting

It doesn’t include any other information about each account like balances, debits, and credits like a trial balance does. Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account. Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that. An easy way to explain this is to translate it into personal finance terms.

How HighRadius Can Help You Accelerate Your Business Growth ?

A high current ratio (current assets / current liabilities) indicates that a company can easily pay its short-term debts. Small businesses use the COA to organize all the intricate details of their company finances into an accessible format. The chart of accounts clearly separates your earnings, expenditures, assets, and liabilities to give an accurate overview of your business’s financial performance. The chart of accounts helps break down all financial transactions into categories.

What is your current financial priority?

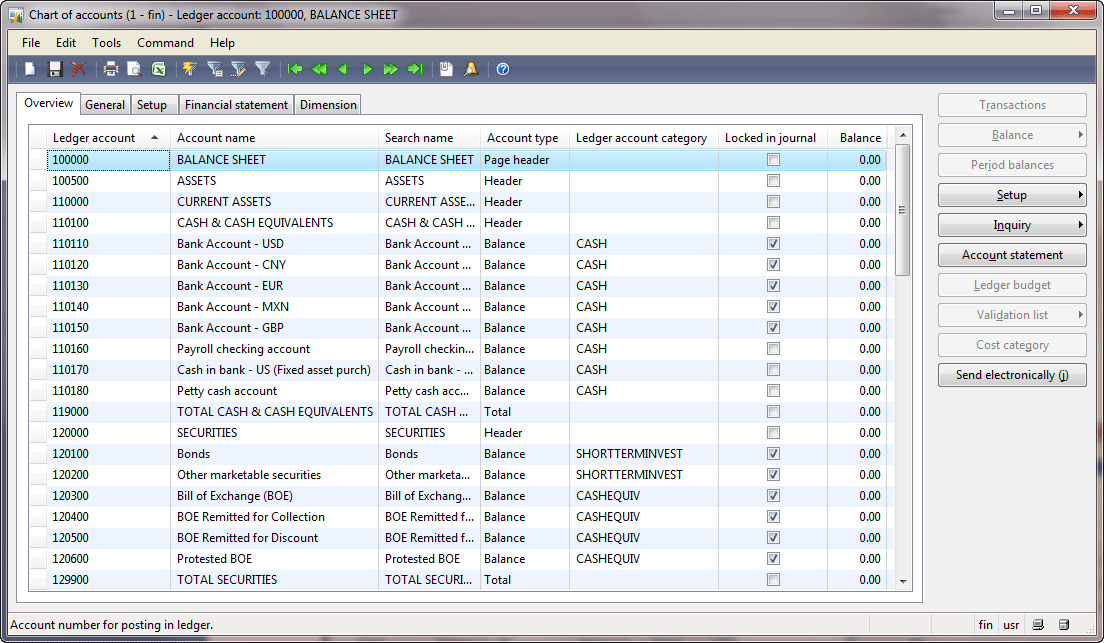

On the other hand, a balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. The balance sheet is generated using the data from the chart of accounts, which is separated into assets, liabilities, and equity sections. A chart of accounts organizes your finances into a streamlined system of numbered accounts.

Customize according to your business needs

Discover how doola Bookkeeping can support your growth ambitions by providing the expertise and tools necessary for precise and efficient financial management. Enhancing accuracy and efficiency in financial management is a cornerstone of doola Bookkeeping. On the other hand, a streamlined chart of accounts enhances transparency and accountability, which can be critical when seeking investors or securing loans. Besides the renumbering and renaming of newly set up G/L accounts, you can also rename and renumber existing G/L accounts in your production system, as long as they have zero postings.

What does COA stand for?

Traditionally, each account in the COA is numbered, and accountants can quickly identify its type by the first digit. For example, asset accounts for larger businesses are generally numbered 1000 to 1999 (or 100 to 199), and liabilities are generally numbered 2000 to 2999 (or 200 to 299). Small businesses with fewer than 250 accounts might have a different numbering system. A COA is a list of the account names a company uses to label transactions and keep tabs on its finances. You use a COA to organize transactions into groups, which in turn helps you track money coming in and out of the company. An adequately structured chart of accounts provides clear insights into your financial health, helping you make strategic decisions that foster growth.

- This is followed by the income statement, which includes revenue and expense accounts.

- The structure of the chart of accounts makes it easier to locate specific accounts, facilitates consistent posting of journal entries, and enables efficient management of financial information over time.

- The bookkeeper would be able to tell the difference by the account number.

- Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that.

- Automated tools like expense management software can create essential documents, including charts of accounts, income statements, and balance sheets.

Secure and backup data

Instead of lumping all your income into one account, assess your various profitable activities and sort them by income type. In the interest of not messing up your books, it’s best to wait until the end of the year to delete old accounts. It’s not always fun seeing a straightforward list of everything you spend your hard-earned money on, but the chart of accounts can give you an important view of your spending habits.

A chart of accounts, or COA, is a complete list of all the accounts involved in your business’ day-to-day operations. Your COA will most often be referred to when recording transactions in your general ledger. Income is often the category that business owners underutilize the most. Some of the most common types of revenue or income accounts include sales, rental, and dividend income. While some countries define standard national charts of accounts (for example France and Germany) others such as the United States and United Kingdom do not.

Asset, liability and equity accounts are generally listed first in a COA. These are used to generate the balance sheet, which conveys the business’s financial health at that point in time olive and poppy 1 and whether or not it owes money. Revenue and expense accounts are listed next and make up the income statement, which provides insight into a business’s profitability over time.

Agregar un comentario

Debes iniciar sesión para comentar.