Boost Your Business: Improve Average Payment Period

The given formula can measure the average payable period with the application of the following steps. Let’s analyze the concept from suppliers’ perspective as they are primary stakeholders in the average payment period of the business. Again, there are two sides of the equation where profitability and liquidity act in a reverse direction. An average collection period of 30 days indicates that the company typically collects its accounts receivable within a 30-day timeframe.

Ready to transform your AP?

- The average payment period calculation can reveal insight about a company’s cash flow and creditworthiness, exposing potential concerns.

- If it can, that could make for a nice increase to the bottom line, as 10% is a huge difference in the clothing industry.

- For suppliers and creditors, a shorter APP is desirable as it ensures quick payment.

- Most often companies want a high DPO as long as this doesn’t indicate it’s inability to make payment.

- If the average payable period is more than normal practice, it may indicate a higher liquidation risk.

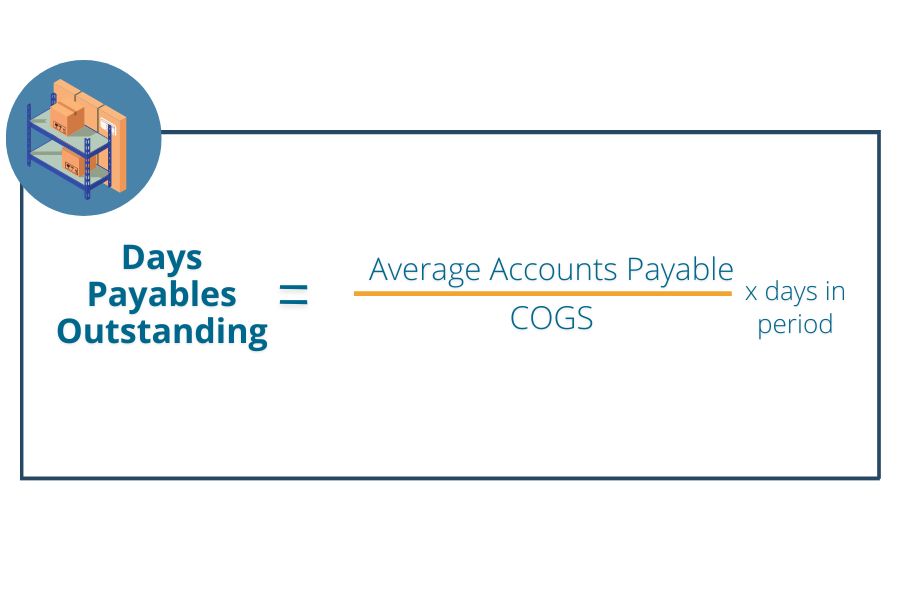

Opening and closing balance of accounts payable for XYZ company amount to $20,000 and $30,000 for the year ended June 31, 2021. The average payment period is calculated by dividing pending payment by the cost of goods sold (COGS) and multiplying this by the number of days in the period. Both are critical financial metrics that provide insights into a company’s cashflow management, but they measure different aspects. By showcasing the diverse effects on various sectors, these case studies will provide a holistic view of how the average payment period can directly influence business success. While abstract principles provide a solid foundation of understanding, real-world case studies often serve as the best teachers. These transparent, practical examples can offer vital insights into the impact of the average payment period on a company’s overall financial health and success.

Advantages of Average payment period

Suppliers may even offer discounts or favorable terms to businesses that demonstrate a consistent pattern of short APPs. If a company is genuinely cash-starved at a certain point in time, the appropriate course of action is to contact your suppliers to explain the situation and request for more time[3]. Companies sometimes measure the accounts payable turnover ratio by only using the cost of goods sold in the numerator. This is incorrect, since there may be a large amount of administrative expenses that should also be included in the numerator.

The Role of Payment Terms in Reducing the Average Payment Period

A high DPO can be a can be a positive sign that a company is using its capital resourcefully, but if it’s too high, it may be struggling to make payments. Conversely, a low DPO could mean that a company change without notice 2020 pays its bills quickly, but it may also be missing out on potential interest by holding cash longer. By evaluating its DPO, it can project its creditworthiness, liquidity, and financial health.

Understanding DSO (Days Sales Outstanding) and its Impact on Average Payment Period

Creditors can use the ratio to measure whether to extend a line of credit to the company. By contrast, days sales outstanding (DSO) is the average length of time for sales to be paid back to the company. When a DSO is high, it indicates that the company is waiting extended periods to collect money for products that it sold on credit. By contrast, a high DPO could be interpreted multiple ways, either indicating that the company is utilizing its cash on hand to create more working capital, or indicating poor management of free cash flow. The typical payment period only considers a company’s credit and payments due to its creditors or investors.

Let’s say your company has an Accounts Payable balance of $200,000, a COGS of $1,000,000, and you’re analyzing over a year (365 days). In another version, the average value of beginning AP and ending AP is taken, and the resulting figure represents the DPO value during that particular period. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

A low DPO is considered to be a positive sign for a company’s financial health, as it shows that the company is able to pay its bills in a timely manner. The major factor that is generally ignored by the investors is that the average payable period should not be computed and compared with companies from different industries. Different companies have different kinds of cash flows and have several factors that determine their average payable period. For instance, in the case of a 10/30 credit term, as a buyer, you might benefit from a 10 percent discount, granted that the balance is paid within 30 days.

The average collection period ratio measures a company’s time to collect receivable balance from its customers. The ratio, showing the average receivables, indicates the efficiency of the company’s credit and collection policies. Drafting and enforcing effective payment terms can minimize the risk of overdue accounts and maintain a healthy cash flow. Primarily, these terms should find a balance between ensuring your financial stability and maintaining positive customer relationships. In any business, striking a balance between maintaining positive customer relations and optimizing cash flow by reducing the average payment period is a key to success.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. All of the values for these variables can be found on the company’s financial statements. Carbon Collective is the first online investment advisor 100% focused on solving climate change. We believe that sustainable investing is not just an important climate solution, but a smart way to invest. On the contrary, if the business is more focused on creditworthiness, it may raise more finance and incur interest charges.

Agregar un comentario

Debes iniciar sesión para comentar.