What Is the Current Ratio? Formula and Definition

The current ratio of such entities significantly alters as the volume and frequency of their trade move up and down. In short, these entities exhibit different current ratio number in different parts of the year which puts both usability and reliability of the ratio in question. Current liabilities include accounts payable, wages, accrued expenses, accrued interest and short-term debt. A higher current ratio is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments.

Changes in Accounting Policies – Common Reasons for a Decrease in a Company’s Current Ratio

A current ratio less than one is an indicator that the company may not be able to service its short-term debt. These calculations are fairly advanced, and you probably won’t need to perform them for your business, but if you’re curious, you can read more about the current cash debt coverage ratio and the CCC. You can find them on your company’s balance sheet, alongside all of your other liabilities.

Current ratio vs. quick ratio vs. debt-to-equity

- It’s ideal to use several metrics, such as the quick and current ratios, profit margins, and historical trends, to get a clear picture of a company’s status.

- These assets are listed on a company’s balance sheet and are reported at their current market value or the cost of acquisition, whichever is lower.

- Negative working capital implies that the company may struggle to meet its financial obligations.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- A company may have a high current ratio but struggle to meet its short-term obligations if it has negative cash flow.

- The quick ratio is a strategic tool that offers insight into your company’s liquidity and financial readiness.

But, during recessions, they flock to companies with high current ratios because they have current assets that can help weather downturns. As with many other financial metrics, the ideal current ratio will vary depending on the industry, operating model, and business processes of the company in question. You calculate your business’s overall current 4 best monthly financial management report template ratio by dividing your current assets by your current liabilities. In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio.

Investor Perspective on Improvement

It all depends on what you’re trying to achieve as a business owner or investor. The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business. On the other hand, the current liabilities are those that must be paid within the current year. The current assets are cash or assets that are expected to turn into cash within the current year. Current ratios can vary depending on industry, size of company, and economic conditions.

Excess inventory can tie up cash and reduce a company’s ability to meet short-term obligations. A company can reduce inventory levels and increase its current ratio by improving inventory management. The ideal ratio will depend on a company’s specific industry and financial situation.

For example, a company may have an excellent current ratio, but if its current assets are mostly inventory, it may have difficulty meeting short-term obligations. One of the simplest ways to improve a company’s current ratio is to increase its current assets. This can be achieved by increasing cash reserves, accelerating accounts receivable collections, or reducing inventory levels.

Current liabilities are also reported on a company’s balance sheet and are typically listed in order of when they are due. In conclusion, while the current ratio offers valuable insights into a company’s short-term liquidity, it is essential to recognize its limitations and consider contextual factors. This comprehensive analysis will help ensure that decision-makers have a more accurate understanding of a company’s liquidity position. A high current ratio could indicate that a company has a surplus of current assets, which seems positive in terms of liquidity.

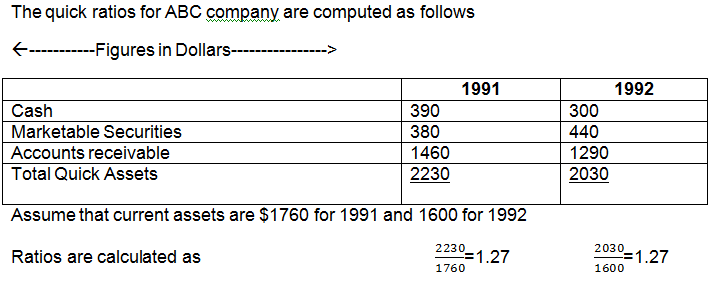

Large retailers can also minimize their inventory volume through an efficient supply chain, which makes their current assets shrink against current liabilities, resulting in a lower current ratio. This is why it is helpful to compare a company’s current ratio to those of similarly-sized businesses within the same industry. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. Traditionally, calculating the quick ratio was a manual process, where finance teams would pull data from various sources, including balance sheets and accounts, to gather current assets and liabilities. First, the quick ratio excludes inventory and prepaid expenses from liquid assets, with the rationale being that inventory and prepaid expenses are not that liquid.

Agregar un comentario

Debes iniciar sesión para comentar.