Cash Flow Statement Example Template How to Prepare Explanation

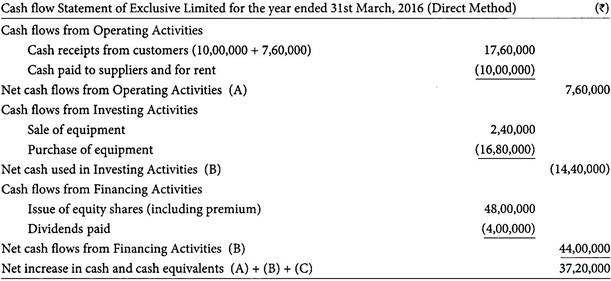

The starting cash balance is necessary when leveraging the indirect method of calculating cash flow from operating activities. What makes a cash flow statement different from your balance sheet is that a balance sheet shows the assets and liabilities your business owns (assets) and owes (liabilities). The cash flow statement simply shows the inflows and outflows of cash from your business over a specific period of time, usually a month. Cash flows from financing consists of cash transactions that affect the long-term liabilities and equity accounts. In other words, the financing section on the statement represents the amount of cash collected from issuing stock or taking out loans and the amount of cash disbursed to pay dividends and long-term debt. You can think of financing activities as the ways a company finances its operations either through long-term debt or equity financing.

How to Read (and Understand) an Income Statement

LO 16.5The following are excerpts from HamburgCompany’s statement of cash flows and other financial records. By learning how to create and analyze cash flow statements, you can make better, more informed decisions, regardless of your position. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. The Cash Flow statement is an integral part of the Financial Statements.

- For small businesses, Cash Flow from Investing Activities usually won’t make up the majority of cash flow for your company.

- If this wasn’t intentional (or expected), your priority needs to be getting back in the black here.

- Do these facts automatically lead to theirinclusion as elements of the financing section of the statement ofcash flows?

- Mastery of cash flow classification, assessment of operating, investing, and financing activities, and understanding cash flow implications is essential.

- The cash flow statement will not present the net income of a company for the accounting period as it does not include non-cash items which are considered by the income statement.

Indirect Cash Flow Method

From the following balance sheet of Star Mills Ltd., prepare a cash flow statement. It focuses on the speed of cash being collected from debtors, stock, and other current assets, as well as the use of cash in paying current liabilities. Operating cash flows are calculated by adjusting net income by the changes in current asset and liability accounts.

Get Any Financial Question Answered

This approach lists all the transactions that resulted in cash paid or received during the reporting period. The cash flow statement helps business owners, investors, and financial managers see the “real” cash available to pay bills, invest in growth, or handle unexpected expenses. Together with the income statement and balance sheet, this statement adds depth to the financial overview, especially for understanding how cash flows in and out over time.

Please review the Program Policies page for more details on refunds and deferrals. Our easy online application is free, and no special documentation is required. stimulus checks on the way for turbotax customers after snafu that sent money to wrong bank accounts All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program.

The indirect method of calculating cash flow

LO 16.3Use the following information from BirchCompany’s balance sheets to determine net cash flows from operatingactivities (indirect method), assuming net income for 2018 of$122,000. After calculating cash flows from operating activities, you need to calculate cash flows from investing activities. This section of the cash flow statement details cash flows related to the buying and selling of long-term assets like property, facilities, and equipment. Keep in mind that this section only includes investing activities involving free cash, not debt.

By analyzing these sections, investors can assess whether management is efficiently using cash to support the company’s core operations, invest in long-term assets, and manage debt and equity. Consistent positive cash flows from operations, prudent investments, and effective financing strategies indicate strong management performance. So we’ve got operating activities, investing activities, and financing activities. So notice, we’ve talked about current assets and liabilities, we’ve talked about long-term assets, well guess what? The financing activities, they deal with our investors and our creditors, and it’s the rest of our balance sheet. So that’s every part of our balance sheet is now being focused on through our cash flow statement.

It’s an asset, not cash—so, with ($5,000) on the cash flow statement, we deduct $5,000 from cash on hand. These three activities sections of the statement of cash flows designate the different ways cash can enter and leave your business. You’ll also notice that the statement of cash flows is broken down into three sections—Cash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities. Let’s look at what each section of the cash flow statement does. Since it’s simpler than the direct method, many small businesses prefer this approach.

The change in the long-term liabilities indicates repayment and borrowing of cash. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Arjun has since written for investment firms, consultants, and SaaS brands in the Accounting and Finance space. So, it naturally follows that investors, creditors, and other interested parties would want to know as much as possible about a company’s cash receipts and cash payments. Lastly, at the bottom of all financial statements is a sentence that informs the reader to read the notes to the financial statements. The reason is that not all business transactions can be adequately expressed as amounts on the face of the financial statements. You can earn our Cash Flow Statement Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium financial statements materials.

Agregar un comentario

Debes iniciar sesión para comentar.