Paid in Capital in Excess of Par Explained for Finance Professionals

At the time of incorporation of the company, promoters and investors purchase the shares. Firstly, the authorized share capital is fixed by the company beyond which the company cannot issue the shares in the market. So initially, the balance sheet issued, and paid-in capital is recorded at the par value.

isCompleteProfile ? “Setup your profile before Sign In” : “Profile”

This number indicates the total amount of money that individual investors and institutional investors have staked on a company’s success. Companies may buy back shares from time to time in order to reduce the total number of their shares in circulation. This is a popular move among shareholders, who are likely to see their shares increase in value. Paid-in capital is not a day-to-day revenue stream for a public company, and its value does not fluctuate. Investguiding is a website that shares useful knowledge and insights for everyone about finance, investing, insurance, wealth, loans, mortgages, and credit. If you need help with paid-in capital, you can post your question or concern on UpCounsel’s marketplace.

paid-in capital in excess of par value – preferred stock

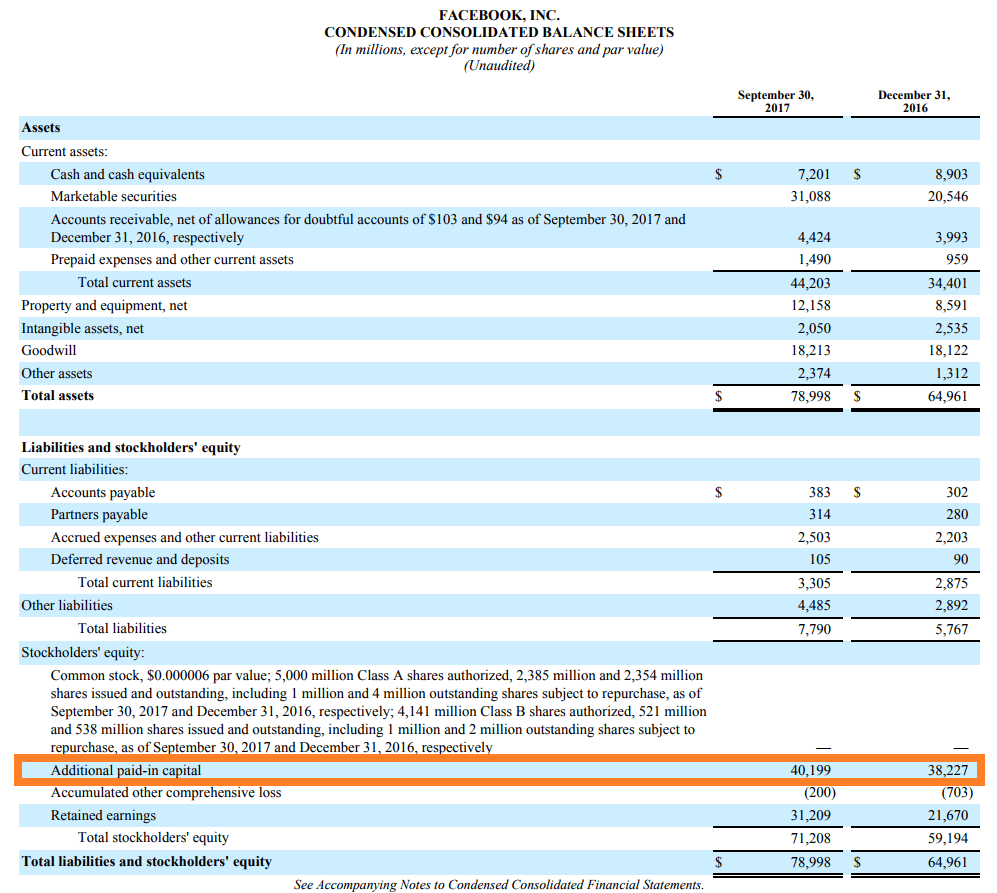

It represents the price that an investor is willing to pay for the stock in excess of its par value, in exchange for a stake in the company. – For example, if 1,000 shares of $10 par value common stock are issued by at a price of $12 per share, the additional paid-in capital is $2,000 (1,000 shares x $2). Additional paid-in capital is shown in the Shareholders’s Equity section of the balance sheet. Additional paid-in capital is an accounting term, whose amount is generally booked in the shareholders’ equity (SE) section of the balance sheet. A working capital ratio of 1.0 indicates the company’s readily available financial assets exactly match its current short-term liabilities.

Common vs. Preferred Stock

Additional paid-in capital can provide a significant part of a young company’s resources before earnings start accumulating through multiple profitable years. It is an important layer of defense against potential business losses if retained earnings show a deficit. However, some company stocks have a no par value, which means there is no minimum number for each share. Therefore, if the stock falls below that price, shareholders do not have to worry about being liable to creditors if the company goes broke.

- Investors value preferred stock shares for their steady returns, not for their price growth, which can be minimal.

- When a company issues shares of stock to raise capital, it is common for the shares to be sold at a price higher than the par value.

- In this case, it signifies the face value that a business gives to a particular stock during its IPO.

- You can find paid in capital listed under the stock holder’s equity or additional paid-in capital.

- McDonald’s total paid-in capital consists of $16.6 million in common stock par value plus additional paid-in capital of $60.235 billion.

FAR CPA Practice Questions: Capital Account Activity in Pass-through Entities

Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. A paid-in capital account does not show the individual contributions of each investor, just the total amount provided by all investors. Ultimately, the decision of whether or not to keep excess capital is up to the individual investor and will depend on their specific goals and objectives. We get a total APIC of $490,000 multiplied by the total number of shares of 10,000.

Since APIC represents the payment investors make in exchange for new shares, existing shareholders do not give up a portion of their ownership in the company. It provides a source of funding for companies without incurring additional debt, allowing them to finance growth and expansion. From an accounting perspective, it allows companies to raise capital without increasing their debt. This element is an important component of a firm’s equity and can be exploited to assess its economic health, growth potential, or capital-raising capacity. Paid-in capital (or contributed capital) is that section of stockholders’ equity that reports the amount a corporation received when it issued its shares of stock. It is recorded as a credit under shareholders’ equity and refers to the money an investor pays above the par value price of a stock.

For sales of common stock, paid-in capital, also referred to as contributed capital, consists of a stock’s par value plus any amount paid in excess of par value. In contrast, additional paid-in capital refers only to the amount of capital in excess of par value, or the premium paid by investors in return for the shares issued to them. Additional paid-in capital is the amount of capital contributed to a company by an investor that is greater than the par value of the issued stock.

As an example, let’s say Widget Company issues 100 shares of stock with a $0.01 par value. The company then sells those shares for an average share price of $100, raising $10,000. In this case, the paid-in capital is $10,000, the par value is $1, and the additional paid-in capital is $9,999. A preferred stock issue paid in capital in excess of par is another way for a company to raise cash for its business. This hybrid of a stock and a bond appeals to investors who want a steady dividend payment and protection of their capital from bankruptcy. In this instance, the additional paid-in capital is $10 million ($11 million minus the par value of $1 million).

Agregar un comentario

Debes iniciar sesión para comentar.