Difference Between Sales Book and Sales Account with examples

In the 21st century, The New York Times has shifted its publication online amid the global decline of newspapers. The first step in any sale process is an in-depth understanding of the company´s value. This means not just in terms of accounting figures, but also identifying the assets and liabilities which may affect the transaction.

Explore More List Building Terms

Each sales account is typically assigned to either one salesperson (if the account is a small one) or to a team of salespeople (if the account is a major one). For example, if the company has unsecured debts or unresolved legal risks, it is essential to work on solutions to mitigate such risks before putting the business on the market. This proactive approach requires time and resources, but it usually translates into a considerable increase in the value perceived by buyers, and leads to smoother negotiations. Choosing between a total or partial sale will depend on the owner´s long-term objectives. In Spain, many business owners opt for a partial sale which ensures succession, particularly in the case of family companies which seek to maintain a legacy for subsequent generations, while benefitting from new capital to modernise the business.

Example of a Sales Account

Plus, SMB opportunities are usually pretty manageable without the need for extensive planning. According to one study, 44% of companies actually rely more on acquisition for existing accounts. Interestingly enough, the same study also showed that customer retention is more important to your business financially—just a 5% rise in retention rates can equal a profit increase between 25-90%. We built SalesHive on the premise that modern sales development was flawed, and the companies building outsourced programs were only contributing to that.

How Liam Passed His CPA Exams by Tweaking His Study Process

The New York Times has been involved in several controversies in its history. The Times maintains several regional bureaus staffed with journalists across six continents, and has received 137 Pulitzer Prizes as of 2023, the most of any publication, among other accolades. Hitesh Bhasin is the CEO of Marketing91 and has over a decade of experience in the marketing field. He is an accomplished author of thousands of insightful articles, including in-depth analyses of brands and companies. Holding an MBA in Marketing, Hitesh manages several offline ventures, where he applies all the concepts of Marketing that he writes about. Making transactions transparent is useful for business during filing taxation and also if any discrepancy arises.

- Having transparent transactions not only helps business but also helps the customers to form a trust over the organization regarding the ethics it follows.

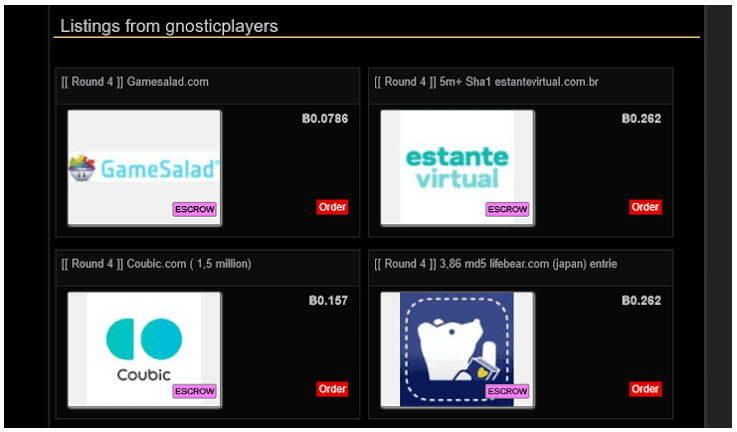

- Still, despite the danger, these web pages remain as go-to places for both buyers and sellers.

- The monthly statements include separate listings for each sub-account, which facilitates the firm’s required record-keeping for funds it is holding.

- Lawyers may charge administrative fees for the time and work involved in handling escrow funds entrusted to them and doing the required record-keeping for those funds.

- In my experience, one of the greatest risks for a successful sale is the emergence of unexpected problems during the due diligence.

- The second cardinal rule is that lawyers may not deposit their own personal or business funds in their escrow or trust accounts.

So, looking to buy a game account, or maybe you want to sell game accounts? As gaming became a popular and readily available hobby, earning money through it has become as easy and familiar as selling used games, in-game accounts, or even piloting services. Then there is the practice of selling Steam what overtime pay is and how to calculate it accounts, a run through that has been appealing to both buyers and sellers. If you want to understand how to sell steam games, then start figuring out what is your Steam account value. During the due diligence, buyers will assess the business´ entire financial, legal and operational status.

First, commingling of personal and trust funds may destroy the escrow nature of the account and expose the clients’ funds to the risk of attachment by the lawyer’s or law firm’s creditors. Second, commingling of personal and trust funds makes it much harder to determine if the lawyer has used, or misused, any of the trust funds which were supposed to be held intact. Lawyers are permitted to maintain their trust accounts only at those New York banks which agree to provide bounced check reports to the Lawyers Fund for Client Protection. Unless the returned check is clearly the result of a bank error and the bank acknowledges the error in writing to the disciplinary committee, the lawyer will be required to produce his or her escrow records for the previous six-month period. Most investigations based upon bounced check reports are closed with no finding of wrongdoing by the lawyer or law firm and no discipline imposed.

In bookkeeping, accounting, and financial accounting, net sales are operating revenues earned by a company for selling its products or rendering its services. Also referred to as revenue, they are reported directly on the income statement as Sales or Net sales. Take a look at your existing customers and determine which accounts are the most strategic ones. Maybe they’re a flight risk, or it’s almost time for them to renew their contract with you. Then, put together sales accounts plans for this group of customers so that when it comes time for them to renew, you’re prepared to make sure they do. Account planning, while effective, does take a fair amount of time and resources.

It also positions your product is a long-term solution, not just a quick fix. The account total is then paired with the sales returns and allowances account to derive the net sales figure that is listed at the top of the income statement. All monthly bank statements, cancelled checks, deposit slips, check books and check stubs must be maintained for seven years. In addition, the firm must keep a “record” of all deposits into and withdrawals from every escrow or trust account, as well as every law firm operating account. That “record” must include the “date, source and description” of every deposit and the “date, payee and purpose” of every withdrawal. These rules are neither obvious nor intuitive and lawyers who are not familiar with them practice at their peril.

Funny enough, however, 19% of the highest-performing sales reps would disagree and would recommend acting as an account manager for existing accounts. The Times has expanded to several other publications, including The New York Times Magazine, The New York Times International Edition, and The New York Times Book Review. In addition, the paper has produced several television series, podcasts — including The Daily — and games through The New York Times Games.

The EBITDA multiple and Discounted Cash Flow valuation methods are two of the most common in Spain. They both offer complementary perspectives of a company´s value, and provide a solid justification of the sale price to potential buyers. Another essential use of record-keeping is to produce proof of transactions during taxation. This will help the accountant to find a particular deal easily at any given point in time.

Agregar un comentario

Debes iniciar sesión para comentar.